Ho Chi Minh City, 27 August 2021, VietCredit Finance Joint Stock Company (VietCredit) cooperates with Kredivo – Indonesia’s leading Fintech company to deploy the product “Buy Now Pay Later” on the digital platform. This cooperation helps Vietnamese consumers easily access modern financial solutions and makes online shopping faster with more choices than ever before.

Basic understanding “Buy Now Pay Later” (BNPL) is a type of short-term financing that allows consumers to buy goods immediately without paying the entire amount at once. Consumers can divide their total purchases need to be paid into a series of installments in each period, usually lasting from one to several months without incur any additional costs if pay on time. In the past, consumers are used to paying installments to purchase electronics, motorbikes, etc., or shop online with paying by credit card. Then now, consumers can still buy everything on the E-commerce platform through BNPL without having a credit card.

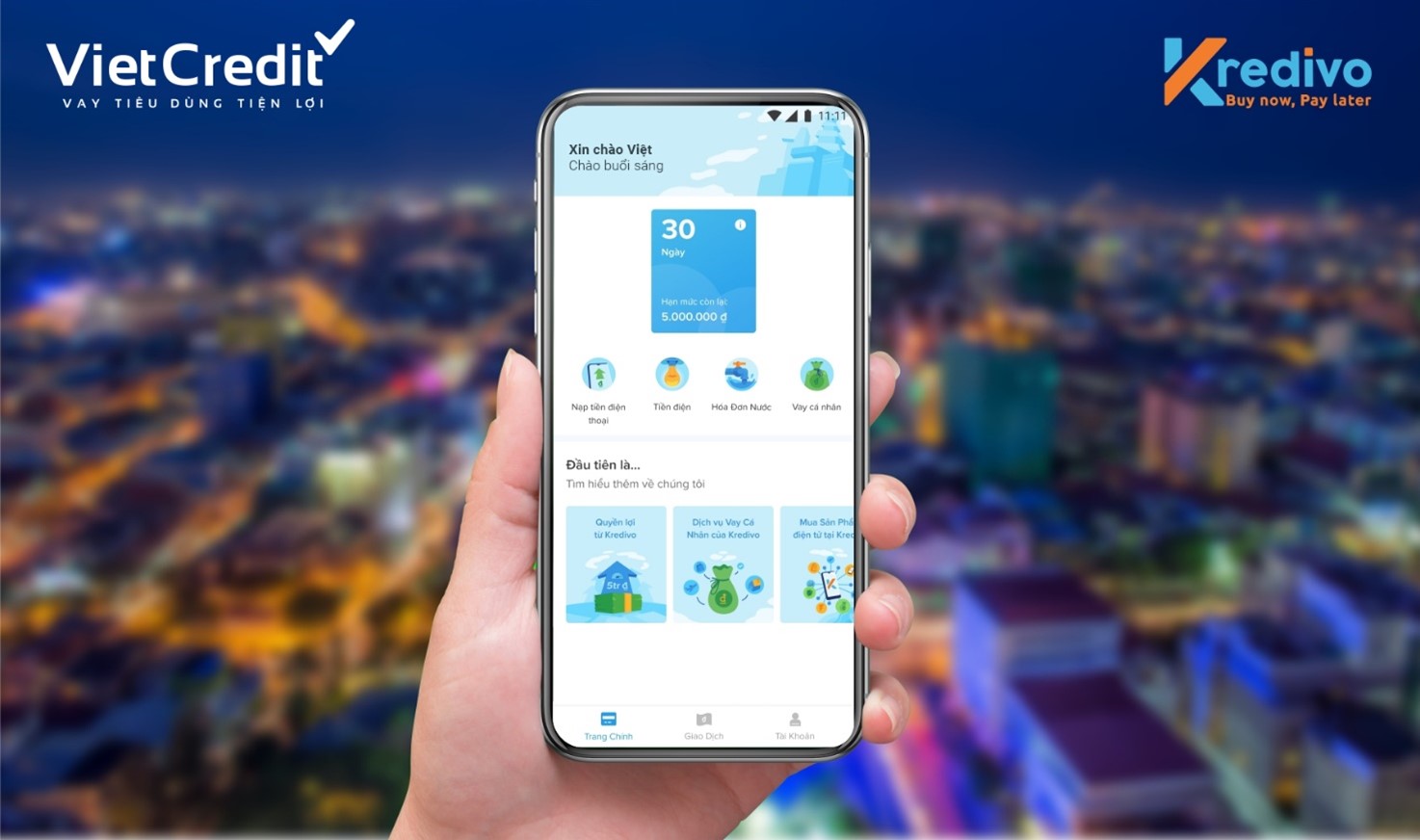

The outstanding features of BNPL are the simple, easy-to-use, convenient registration procedure on mobile devices, and various products will meet the actual need of consumers. BNPL is also attractive in another feature that allows consumers to shop instantly without having a credit card. This feature offers an experience quickly and easily online shopping to consumers who are not eligible to apply for a credit card. Consumers can buy a pair of shoes, a set of clothes, or daily consumer products at a suitable price through BNPL. In addition, consumers can also use loans through BNPL to pay monthly bills such as electricity, water, internet, etc.

In Vietnam, BNPL is still a new trend but it is expected to explode in the near further because Vietnam is a potential market with large population, in which young people (Millennials 18-40 years old) make up majority. With the advantage of a high rate of using mobile devices and the internet, more and more people prefer to use technology applications to spend on shopping.

Especially, the Covid-19 pandemic has changed consumer behavior from shopping in traditional land-based retail stores to shopping online. According to the Vietnam Consumer Survey of Deloitte in 2020, the trend of online shopping has been increasing from 68% – 76% of young people aged 20 – 40 who have a frequency from 1-3 times/month for shopping via E-commerce. The Vietnam E-commerce Association forecasts that from 2021-2025 will be a period of the explosive development of E-commerce with an average growth rate up to 29% compared to 15% in 2020 that brings more great opportunities for E-commerce platforms to thrive in the future. Thanks to those above factors, the BNPL model will be strongly promoted and soon popularized in Vietnam.

Therefore, through the collaboration with Kredivo to implement BNPL, VietCredit aims to solve unmet personal financial needs, bring Vietnamese consumers closer to advanced financial trends, optimize customers’ digital financial experience of in a complete and seamless way, especially for young customers in the current digital age. Thereby, VietCredit can enhance its competitive advantage in the market.

At the same time, BNPL contributes to popularizing the modern, secure and convenient electronic payment methods through the digital transformation. Thus, BNPL strongly promotes contactless transactions, non-cash payments that the Vietnamese Government and the State Bank of Vietnam are actively promoting.

Tam Minh Ho, VietCredit CEO, said: “Using technology of Fintech to create an extended way to reach potential customers has affirmed the acumen of VietCredit in conquering the consumer finance market with the majority of young customers.”

“The partnership with a large Fintech company like Kredivo also shows the initiative and quickness of VietCredit in complying with the policy of the State Bank of Vietnam. This policy encourages financial companies to cooperate with Fintech companies to develop new solutions and business models with friendly, safe, convenient, and low-cost products and services.”, added Tam.

The products are rolling out into multiple phases. The first phase provides a bill payment solution to meet daily needs and personal lending. In the fourth quarter of 2021, the BNPL E-commerce application will be officially implemented.

As we know about the potential developing market in Vietnam, BNPL will soon become a popular and convenient sevice to promote the strong growth of online shopping. However, based on the customer-oriented businesses strategy, VietCredit always encourages customers not to overspend and should ensure the effective use of loans within their capacity payment.

This important event has been reported by the Vietnamese and International media, please read the details in below!